1910

Captain John Grindrod establishes Grindrod & Company, a clearing and forwarding agency that would grow into a company with diverse operations, including a Shipping Division with globally recognised operational brands – IVS and Unicorn Shipping.

Grindrod Shipping, a company with roots dating back more than a century, lists on the Nasdaq and the JSE.

Captain John Grindrod establishes Grindrod & Company, a clearing and forwarding agency that would grow into a company with diverse operations, including a Shipping Division with globally recognised operational brands – IVS and Unicorn Shipping.

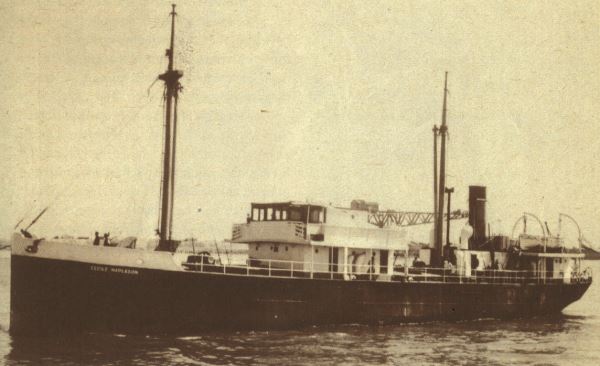

John Grindrod and Leon Renaud buy a small steamer. Grindrod & Company are appointed agents.

The “Wall Street Crash” begins the so-called Great Depression, as global shipping lines suffer the consequences of declining trade and passenger numbers. The fledgeling Grindrod shipping enterprise was also affected.

African Coasters is established that would later become central to the Grindrod shipping operations.

Shipping services are severely dislocated by World War 2. (This included those services operated by African Coasters, some of whose vessels were involved in moving military cargoes.)

The Company celebrates its Golden Jubilee.

South African mining house, Union Corporation, buys a 51 percent shareholding in African Coasters, allowing the company to modernise its fleet. The shareholding was later repurchased, returning control of the company to Grindrod.

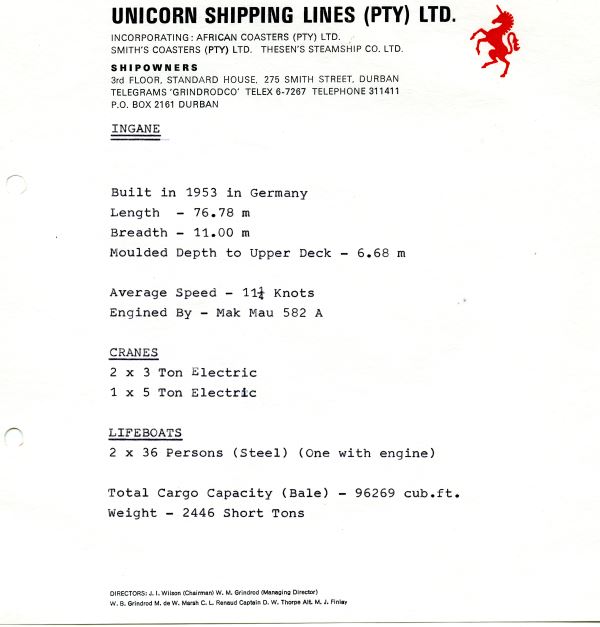

African Coasters and its rival Smith’s Coasters merge, and the shares are transferred to a new company, Unicorn Shipping Holdings (Pty) Ltd. The shipping arm becomes known as Unicorn Lines.

Unicorn buys another South African coasting company, Thesen’s Steamship Company, giving the company a major portion of southern African coastal shipping services.

The Suez Canal closes, forcing thousands of ships to divert to the Cape Route. South African ports are severely congested, again affecting Grindrod-operated shipping services.

The company pioneers containerisation in South Africa and establishes the country’s first container depot and fully containerised coastal container shipping service. (Today, Ocean Africa Container Lines - OACL - provides a container feeder service between ports in Mozambique, South Africa, Namibia and Angola.)

With its purchase of its first large products tanker, Unicorn enters the tanker sector.

Through acquisition, Grindrod expands its ships’ agency operations

Grindrod & Company celebrates 75 years in the shipping industry.

Unrest in Soweto (near Johannesburg) and the subsequent loss of life escalates the wave of anti-apartheid sanctions against South Africa. This begins to take its toll on international shipping operations and the company’s coastal services.

A fully containerised shipping service (SAECS) is introduced between north-west Europe and South Africa. This leads to an expansion of the company’s own containerised coastal feeder services.

Successful negotiations conclude with the purchase of shares in African Coasters Holdings, held by a South African mining house, thus ensuring that control of Unicorn Lines returns to the Grindrod Group.

The company lists on the Johannesburg Stock Exchange through a newly-established holding company, Grindrod Unicorn Group Ltd, known as Grincor. At 31 December 2017, the company’s market capitalisation was in excess of R10.4 billion.

Apartheid is abolished in South Africa and several political reforms in the country begin. Nelson Mandela is released from prison, bringing a wave of investment to South Africa. The subsequent cessation of trade sanctions, and the start of a shipping boom is enhanced by the country’s first fully-democratic election in 1994 after which Nelson Mandela is installed as the country’s president. (The company becomes free to operate fully in international shipping markets.)

Successful negotiations see the repurchase of 40 percent of Unicorn shares, returning full control over the company to Grindrod. Through the purchase of the Durban-based Island View Shipping (IVS), the group enters the dry bulk shipping sector.

The company changes its name to Grindrod Limited.

Global shipping markets begin an upward trend that became the largest shipping boom in history. Grindrod share price increases markedly.

The company’s initial investment in Richards Bay dry-bulk terminals becomes operational.

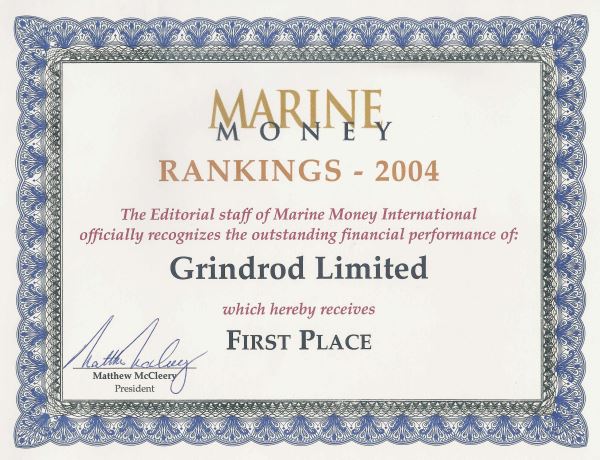

Grindrod wins the Marine Money Award as the top listed international shipping company.

Grindrod wins the top position in the Sunday Times/Business Times Top 100 Companies.

Grindrod acquires Marriott Corporate Property Bank which today trades as Grindrod Bank.

Grindrod wins the Marine Money Award, the first company to win it in consecutive years.

Grindrod wins the Sunday Times/Business Times Top Companies Award for the second successive year.

The company invests in Maputo Port Development Company. This establishes a base for further investments in dry-bulk and car terminals.

Grindrod is the Top Company in Financial Mail’s prestigious Top 20 list, ranked according to historical financial performance and an assessment of future prospects.

Grindrod Group announces record profits for the previous financial year.

The so-called worldwide “Credit Crunch” begins in the USA, and affects the global economy. Coupled with a reduction in Chinese imports, global shipping begins a devastating decline.

Grindrod concludes a major Black Economic Empowerment (BEE) with Brimstone, Calulo and Adopt-a-School Foundation.

Grindrod achieves the Sunday Times/Business Times Top-Listed Company Award over 10 years

The shipping decline continues, adversely affecting worldwide operations. Yet Grindrod achieves good results.

Grindrod Group celebrates its Centenary.

Grindrod enters into a R2 billion equity-raising transaction, underwritten by Remgro Limited to support the group’s strategic development of capital projects in southern Africa.

The company streamlines its freight and logistics services offering by closing its Trading Division. It gears for infrastructural expansion, mainly into the African continent, through a R4.0-billion capital raise, which includes a R1.6-billion Broad-based Black Economic Empowerment consortium transaction, to fund planned strategic investments.

The company announces the investigation of the potential to spin-off its Shipping division following the turn of the shipping cycle in conjunction with the reposition of its other divisions to unlock shareholder value.

Grindrod Shipping lists on Nasdaq and the JSE